#1 Manual Lending, Everything You Need To Know!

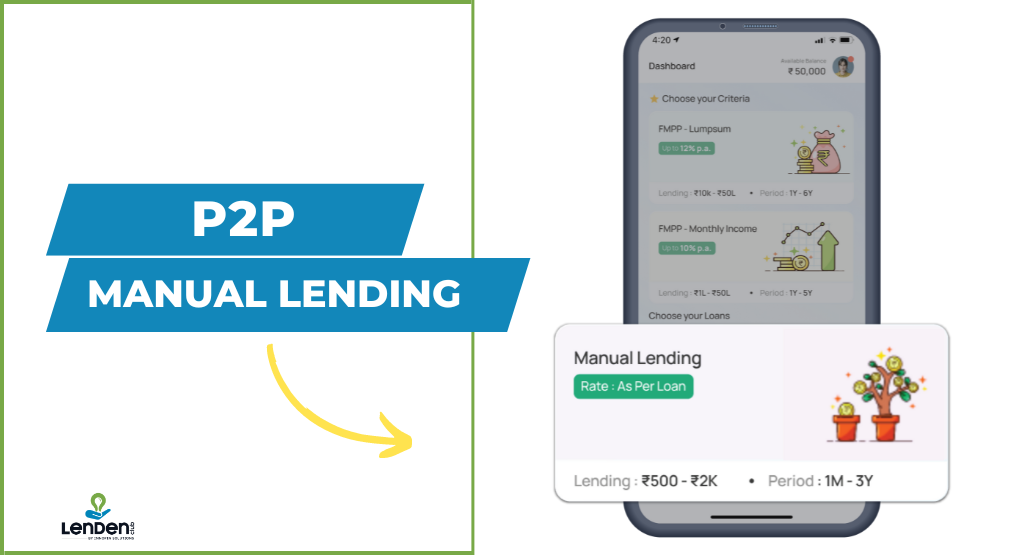

We recently launched manual lending alongside our existing lumpsum and MIP options. Since launching this option in October 2023, our lenders have shown strong interest in it. In this article, we will discuss all that you need to know before you lend manually.

What is Manual Lending?

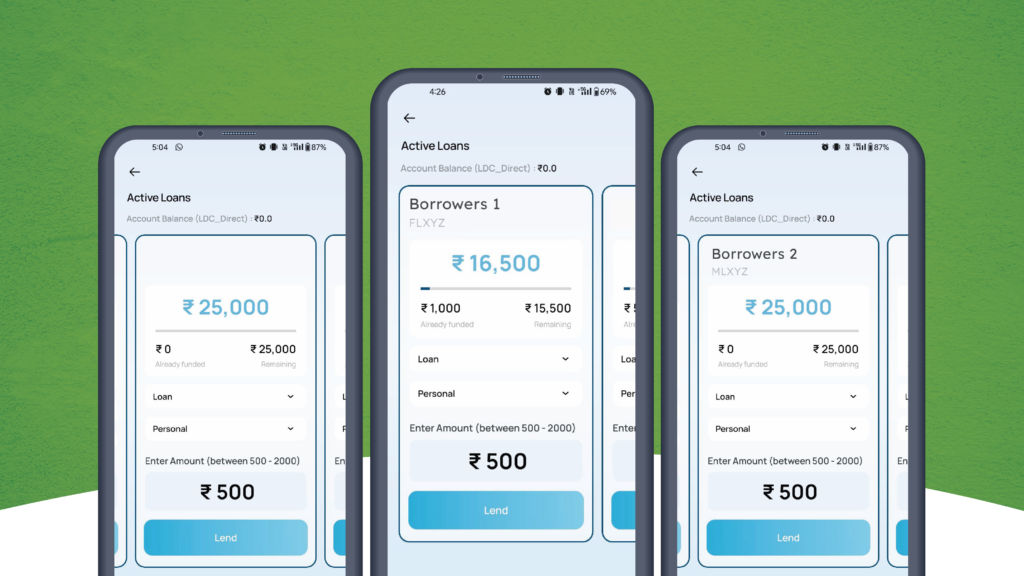

With manual lending, you can now select loans per your criteria. This gives you the flexibility and freedom to make your own decisions. You can view all borrower information when you open a loan under the manual lending section. This information shows bureau score, total loan amount, loan tenure, interest rate, income, and other similar demographic and financial information.

After carefully reviewing these details, you can make your lending decision.

Features of Manual Lending

Manual lending allows you to review all loan-related information and make informed decisions. Below are a few of the features of this new option.

Loan selection: Lenders can manually select borrowers based on demographic, financial, and credit information.

Flexible Loan Tenures: Manual Lending offers flexibility in loan tenures. Lenders can choose to lend for short—or long-term tenures, starting with one month and going up to 36 months.

Risk Management: By carefully examining and selecting borrowers, you can lend your money according to your risk tolerance levels.

Lend as low as ₹500: You can start lending with as little as ₹500 and as high as ₹2000. This allows you to diversify your money into multiple loans to mitigate the risk.

Potential Returns: Manual lending offers the opportunity to earn significantly more returns. These returns differ from loan to loan. However, it is important to note that the higher the interest rate, the bigger the risk. So choose carefully.

Risks associated with Manual Lending:

Lending in loans via manual lending involves significant risks and should be taken cautiously. While manual lending offers the potential for attractive returns, lenders need to understand that losses can and do occur.

Risk of Loss: Some lenders in manual lending may not achieve their expected returns. Lenders should be prepared for partial or total loss of their lent capital.

Impact of Defaults: Lenders face the risk of borrower default, which can significantly impact expected earnings. Despite rigorous credit assessments, not all risks can be mitigated.

Market Conditions: Economic and market conditions can affect borrower repayment capacity and, consequently, loan performance.

Lenders considering manual lending should fully understand the risks involved and consider their lending objectives and risk tolerance levels before lending.

How to mitigate the risk?

Diversification: While diversification can help manage risk, it does not eliminate it. Lenders are encouraged to diversify their lending portfolio but should also understand that diversification alone does not guarantee protection against loss.

Borrower selection: Carefully select the borrowers you lend to. Making a mix of high and low-risk loans can reduce the chances of loss.

Close monitoring: Closely monitor your portfolio. We are building analytical tools to allow you to monitor your portfolio better. You can now download the manual lending report to analyze your current status and make lending decisions. Available only on web for now.

Continuous lending: Continuously lending the repaid sum increases your chances of profit. You should re-lend your capital over a more extended period.

Conclusion

Manual lending is a great option that allows lenders to grow their wealth by lending in loans. It gives you the control and freedom to make your own decisions. However, it is always advised to be cautious and follow the right strategies before lending. In our next article, we will cover the various ways to track your portfolio and repayments. Keep an eye out for it.

Team LenDenClub

LenDenClub is India’s largest alternate investment platform which started operations in India in 2015. We have been helping investors diversify their investments beyond traditional investment instruments ever since.